Impact of Tariff Confrontation on US-China Semiconductor Industry

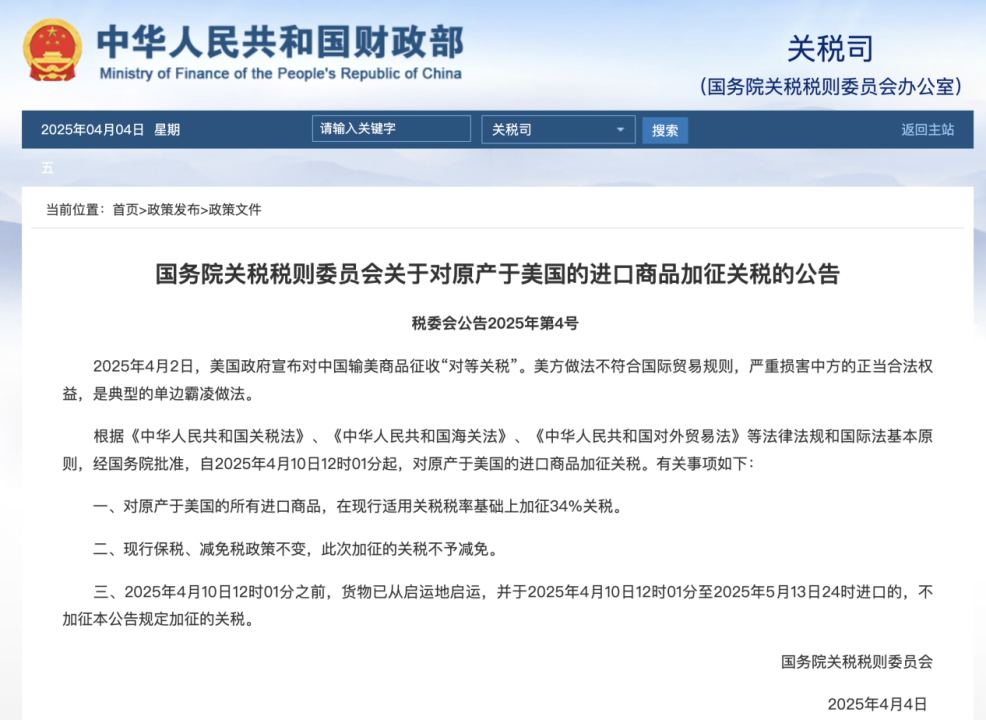

China Announces Retaliatory Tariffs Against the US

On April 7, 2025, in response to the US government’s announcement of “reciprocal tariffs” on Chinese imports, China issued countermeasures. The Customs Tariff Commission of the State Council announced that a 34% additional tariff would be imposed on all imported goods originating from the United States, on top of the current applicable tariff rates.

On April 2, 2025, the US government announced “reciprocal tariffs” on Chinese exports to the US. The US approach violated international trade rules and seriously damaged China’s legitimate rights and interests, representing a typical unilateral bullying practice. According to the “Customs Law of the People’s Republic of China,” “Foreign Trade Law of the People’s Republic of China,” and other laws and regulations, as well as principles of international law, with the approval of the State Council, additional tariffs will be imposed on imported goods originating from the US starting from 12:01 PM on April 10, 2025.

Key points include:

- An additional 34% tariff will be imposed on all imported goods originating from the US, on top of the current applicable tariff rates.

- Current bonded and tax reduction/exemption policies remain unchanged; the additional tariffs will not be reduced or exempted.

- Goods that departed from their place of origin before 12:01 PM on April 10, 2025, and are imported between 12:01 PM on April 10, 2025, and midnight on May 13, 2025, will not be subject to the additional tariffs specified in this announcement.

Additionally, the Ministry of Commerce and the General Administration of Customs launched six parallel measures, including: adding 16 US entities to the export control list, implementing export controls on medium and heavy rare earth-related items, suspending import qualifications for 6 US companies, listing 11 US companies on the unreliable entity list, initiating an industrial competitiveness investigation on imported medical CT tubes, and filing a WTO lawsuit against US “reciprocal tariffs.”

These countermeasures directly target the “reciprocal tariffs” policy announced by the US on April 2, marking a renewed escalation in US-China trade tensions after six years. Notably, the tariff coverage is unprecedentedly broad—from soybeans and automobiles to chips and medical devices, with no exemptions for any US-origin goods. However, the policy also includes a buffer period: goods shipped before April 10 and arriving before May 13 will still enjoy the original tariff rates, providing a window for companies to adjust their supply chains.

In market reactions, US stock futures declined sharply, with Dow futures falling over 1,500 points, Nasdaq 100 futures dropping more than 4%, and S&P 500 futures declining 3.8%. The 2x leveraged fear index surged over 30%, following a nearly 50% rise the previous day. Major US tech stocks fell significantly in pre-market trading: Amazon dropped over 6%, Tesla over 5%, Apple 4.72%, Meta over 4%, Nvidia 3.88%, Microsoft 3.85%, and Google over 3%.

US-China Trade: Key Import Categories

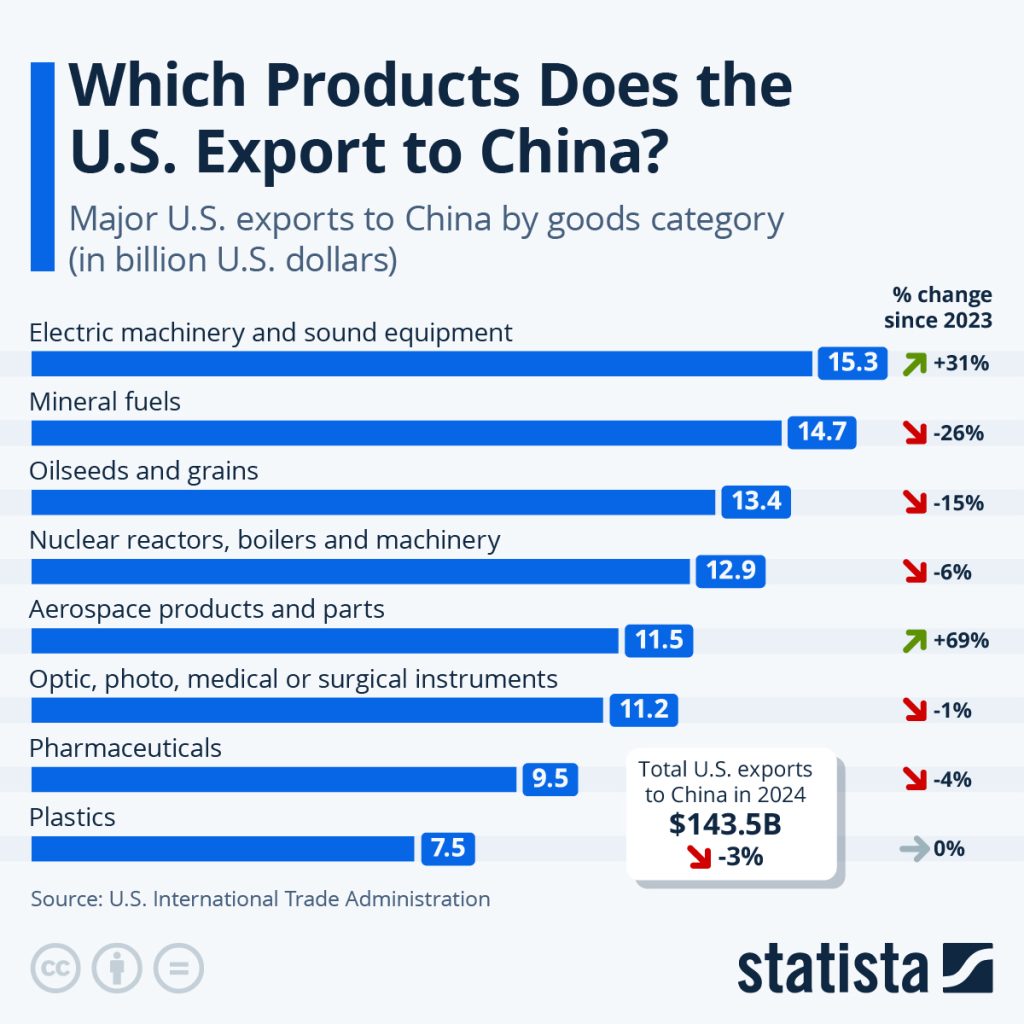

According to statistics released by China’s General Administration of Customs on January 13, the total US-China trade volume for 2024 was $688.28 billion, a year-on-year increase of 3.7%. China’s exports to the US amounted to $524.656 billion, a 4.9% increase.

By product category, the top ten categories of Chinese imports from the US were:

- Machinery and electronic products (23.17%)

- Agricultural and food products (16.33%)

- Energy products (14.12%)

- Chemicals and chemical products (12.62%)

- Transportation equipment (9.33%)

- Precision instruments (7.82%)

- Plastics/rubber and products (5.34%)

- Metals and products (4.35%)

- Wood/wood pulp (1.71%)

- Metal minerals (mainly copper) (1.17%)

Breaking down the top five import categories further:

- Machinery and electronic products: Integrated circuits (7.21%), engines and parts (4.57%), semiconductor manufacturing equipment and parts (2.74%), valves/bearings (1.26%), and communication/audio-visual equipment and parts (0.90%).

- Agricultural and food products: Genetically modified soybeans (7.36%), meat (1.86%), cotton (1.13%), sorghum (1.06%), fruits/nuts (0.79%), feed (0.79%), aquatic products (0.67%), wheat (0.37%), and corn (0.34%).

- Energy products: Liquefied propane/butane (7.11%), crude oil (3.68%), liquefied natural gas (1.48%), coal (1.21%), and petroleum coke (0.35%).

- Chemicals and chemical products: Organic/inorganic chemicals (3.84%), pharmaceutical chemicals (mainly serums/vaccines) (3.44%), cosmetics/cleaning products (1.22%), and backing reagents (1.06%).

- Transportation equipment: SUVs/cars/small passenger vehicles (4.44%) and aircraft (unladen weight ≥ 15 tons) (3.18%).

Overall, agricultural products, energy, and machinery/electronics are the three core import sectors. Due to US-China trade frictions and China’s diversified procurement strategy, the market share of US soybeans, corn, and other agricultural products in China declined in 2024. However, semiconductors and electronic equipment have the highest import value proportion, reflecting China’s dependence on US high-end manufacturing.

Impact on China’s Semiconductor Industry

Increased Difficulty in Equipment and Technology Acquisition

The tariff increase will significantly impact the semiconductor equipment industry. US companies like Applied Materials and Lam Research account for approximately 40% of the global semiconductor equipment market. After the additional tariffs, the import costs of key equipment such as lithography machines and etching machines may increase by more than 50%. This will accelerate the shift of companies like SMIC and Huahong toward domestic equipment. With the continuous maturation of domestic equipment manufacturers’ technology and services, the proportion of equipment localization has been increasing year by year, and this trend will accelerate after this incident.

Increased Import Costs

The price advantage of US products such as Nvidia H20 chips and TI analog chips will be weakened. The tariff increase will directly push up procurement costs for domestic enterprises, and companies relying on imports may face profit compression. With the tariff increase on products like Micron HBM3 and Samsung DDR5 memory, domestic server manufacturers may increase their purchases of domestic storage.

Supply Chain Restructuring and Changes in International Cooperation

China is accelerating cooperation with non-US suppliers to reduce dependence on US technology. For example, some companies avoid tariffs by establishing factories overseas (such as in Southeast Asia or Europe) or signing long-term agreements with European automotive manufacturers to reduce dependence on the US market.

However, it’s worth noting that Southeast Asia has become one of the hardest-hit regions in Trump’s reciprocal tariff list. Vietnam will be subject to a 46% reciprocal tariff, one of the highest rates in Trump’s list. Research firm Bespoke even commented that if a company had previously moved its production line from China to Vietnam, “congratulations—your reciprocal tariff rate is now 46%.”

Apple supply chain companies are undoubtedly among the most “injured.” GoerTek has invested in Vietnam for many years. Since 2012, GoerTek established GoerTek Electronics (Vietnam) Company with a registered capital of $4 million, and in 2019, it established GoerTek Technology (Vietnam) Co., Ltd., mainly producing AirPods, smartphones, drones, and other products.

Similarly, Luxshare Precision invested in Vietnam in 2016, establishing Luxshare Precision (Vietnam) Co., Ltd. in Bac Giang Province, and subsequently set up production bases in Bac Giang and Nghe An provinces. Reportedly, Luxshare Precision mainly produces AirPods, iWatch, TWS, and other products for Apple in Vietnam.

Lens Technology also established Lens Technology (Vietnam) Co., Ltd. in Vietnam. According to financial disclosures, by the end of 2024, Lens Technology had 1.32 billion yuan in construction in progress, mainly for Lens Vietnam’s second park still under construction.

Therefore, while some companies had shifted production from China to Vietnam, with the US imposing a 46% tariff on Vietnam, the choice of production location now includes an additional tariff metric to consider.

Overall, US tariffs and China’s countermeasures will exacerbate supply chain pain in the semiconductor industry in the short term. However, in the long term, this policy will accelerate the localization process and promote technological self-reliance and industrial upgrading. Industry differentiation will further intensify, with companies possessing technological barriers and diversified production capacity layout emerging as winners.

Event Recap: US Announces “Reciprocal Tariffs”

On Wednesday, April 2 (Eastern Time), US President Trump signed two executive orders on so-called “reciprocal tariffs” at the White House, announcing that the US would establish a 10% “minimum benchmark tariff” for all trading partners and impose higher tariffs on multiple trading partners.

Trump stated that the US would impose reciprocal tariffs on dozens of trading partners, though the tariffs would not be entirely reciprocal; the US would charge these countries and regions about half of their composite tax rates.

This series of actions can be described as broadly targeted with transparent pricing. Specifically: China 34%, EU 20%, UK, Brazil, Australia, Singapore, etc. 10%, Thailand 36%, Cambodia 49%, Indonesia 32%, India 26%, South Korea 25%, Japan 24%, and so on.

Additionally, the policy imposes reciprocal tariffs ranging from 1% to 49% on specific trading partners. A key provision of the policy allows for reduced tariffs when at least 20% of a product’s value comes from US-made components, which could have a significant impact on industries that rely on semiconductor imports.

According to a White House press release, ad valorem rates only apply to the non-US components of imported products, provided they meet the 20% US-origin threshold. “US components” are defined as parts produced entirely or substantially processed domestically. To implement this rule, US Customs and Border Protection (CBP) has the authority to collect documents and verify the percentage of US components in imported goods. This measure aims to ensure fair implementation of tariffs while encouraging domestic production.

US Media: Chip Industry “Doomed” Under Reciprocal Tariff Impact

Previously, US media reported that although Trump excluded semiconductors from his reciprocal tariffs, given that most chips are indirectly imported into the US, price increases for numerous products containing chips could hurt chip demand.

Trump not including semiconductors in his reciprocal tariffs might sound good at first, but it actually doesn’t provide much relief for the semiconductor industry. After all, semiconductor products are widely present in an expanding list of consumer goods. Even this exemption may not last long. The Trump administration is preparing to impose separate tariffs on semiconductors, pharmaceuticals, and possibly critical minerals. Clearly, Trump expects tariffs on chips to be implemented “very soon.”

President Trump stated at a White House briefing: “Tariffs on chips will begin very soon, and tariffs on pharmaceuticals will also begin in the near future.”

At least for now, directly imported chips to the US are exempt from tariffs, with total chip imports last year at around $82 billion. However, most chips are indirectly imported. Chips are typically manufactured and packaged overseas before being incorporated into electronic products shipped worldwide, including products sent to the US, which will face tariffs of up to 49%. Even many chips manufactured in the US are sent to Taiwan, mainland China, or Southeast Asia for final assembly before being exported to end customers.

This indirect nature makes it tricky to assess the impact on the semiconductor industry. But one thing is certain: the impact will be enormous.

Semiconductors account for a large proportion of various electronic products, making it relatively easy for many electronic product manufacturers to meet the 20% US content threshold. For example, semiconductor components typically account for 25-40% of consumer electronics such as smartphones, laptops, and tablets, and 35-50% of high-performance gaming equipment like gaming laptops and consoles. In the automotive sector, semiconductor content is 20-30%, with even higher percentages in electric vehicles due to advanced power semiconductors such as silicon carbide (SiC) and gallium nitride (GaN). For data centers and AI infrastructure, the semiconductor content is even more substantial. In servers and data center equipment, 50-70% of the cost goes to semiconductors, including processors, memory, and networking chips. Industrial application equipment and networking equipment (including 5G base stations and Wi-Fi routers) also contain 15-60% semiconductor components.

An analysis by Bernstein Research shows that last year, the US imported about $521 billion in machinery, $478 billion in electronics, and $386 billion in automobiles. These products typically contain large amounts of chips, and if people reduce purchases due to price increases, chip sales will inevitably decline. This will ultimately reduce chip manufacturers’ revenue and growth rates, potentially impacting profits and stock market valuations.

Bernstein analyst Stacy Rasgon noted in a report: “Overall, we don’t see anything positive for the semiconductor sector.”

It’s really hard to find any upside. These tariffs don’t provide chip manufacturers with additional incentives to expand production in the US. Either way, their products are generally exported to Asian supply chains first, then return to the US as tariffed goods. Companies like Texas Instruments and Analog Devices, which have extensive operations in the US, don’t gain more advantages than their foreign counterparts, as foreign competitors also received semiconductor tariff exemptions.

Wolf Research analyst Chris Caso mentioned in a report that the entire supply chain might experience a wave of order cancellations, similar to the COVID-19 lockdowns in 2020, as chip manufacturers and their customers anticipate weaker consumer demand due to price increases. He also noted that consumer electronics would likely be hit hardest, and tariffs would increase the cost of Nvidia’s scarce AI servers, potentially challenging industry profit expectations for the second quarter.

Caso stated: “We believe these impacts simply cannot be avoided.”

Nvidia’s stock price fell more than 6% on Thursday. Chip companies haven’t issued profit warnings yet, indicating that the extent of the impact remains unclear. To mitigate the impact, the chip industry might try to negotiate with the Trump administration to reduce the most impactful tariffs or secure exemptions for more electronic products and other goods containing chips. Ideally, the Trump administration would respond positively by canceling many of the most destructive tariffs. However, given Trump’s consistent preference for taking a tough stance rather than making compromises, the more likely scenario is the imposition of even more tariffs.